2024 1040 Schedule Excel

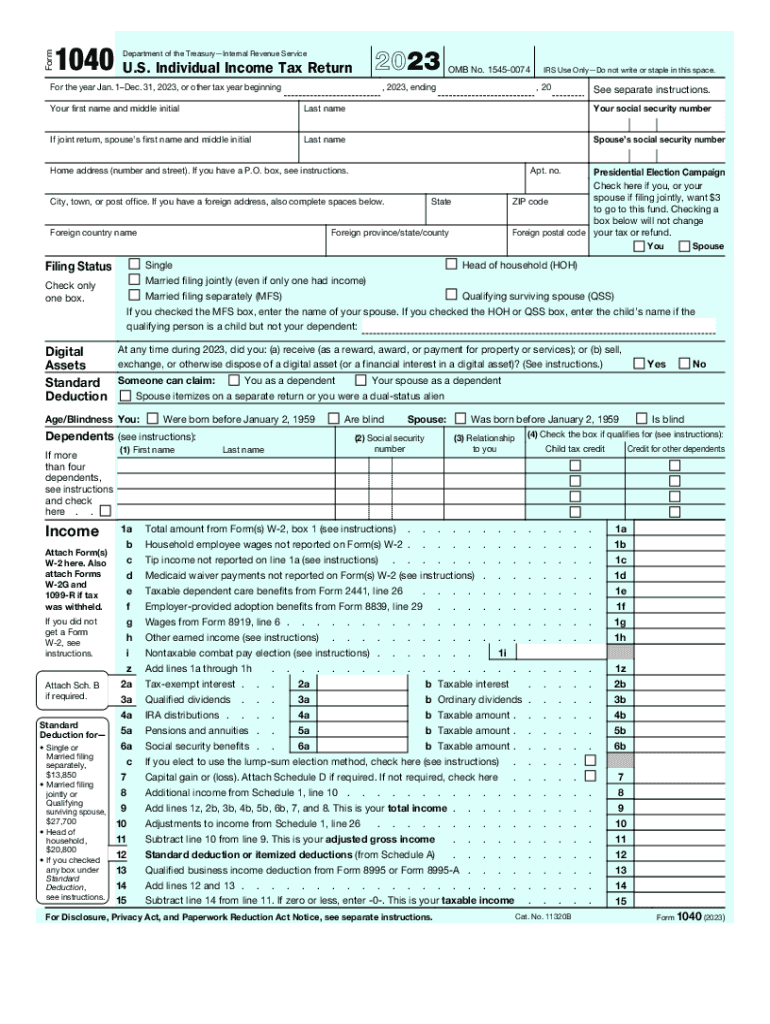

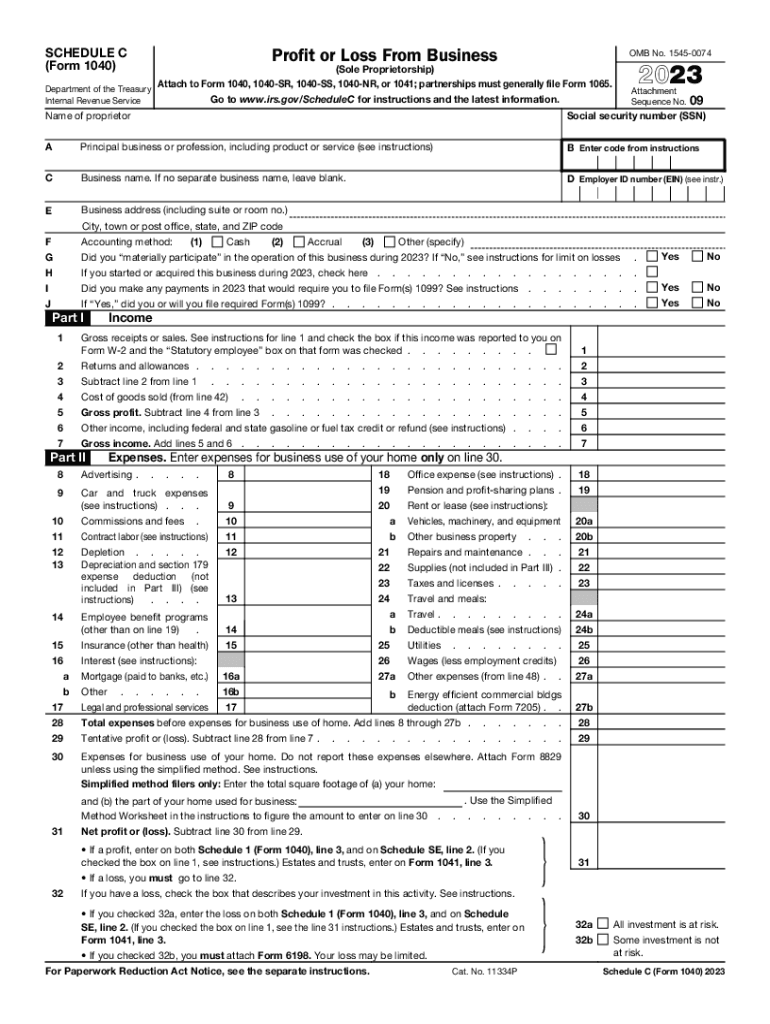

2024 1040 Schedule Excel – Complete IRS 1040 Schedule C, “Profit Or Loss From Business.” On the Schedule C, you are required to enter your name, Social Security number, business name (if applicable), business address . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 1040 Schedule Excel

Source : accidentallyretired.com2024 Calendar With Planner Excel Template 2024 Planner Tracker

Source : www.etsy.com2023 Form IRS 1040 Fill Online, Printable, Fillable, Blank pdfFiller

Source : 1040-form.pdffiller.comUS IRS 1040 form or US Individual income tax Concept, accountant

Source : www.vecteezy.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.com2024 Dated Weekly Planner Excel Template 2024 Editable Planner

Source : www.etsy.com2023 Form IRS 1040 Schedule 8812 Fill Online, Printable

Source : 1040a-child-tax-credit.pdffiller.comHp Elite X360 1040 G10 14″ Touchscreen Convertible 2 In | Beach Audio

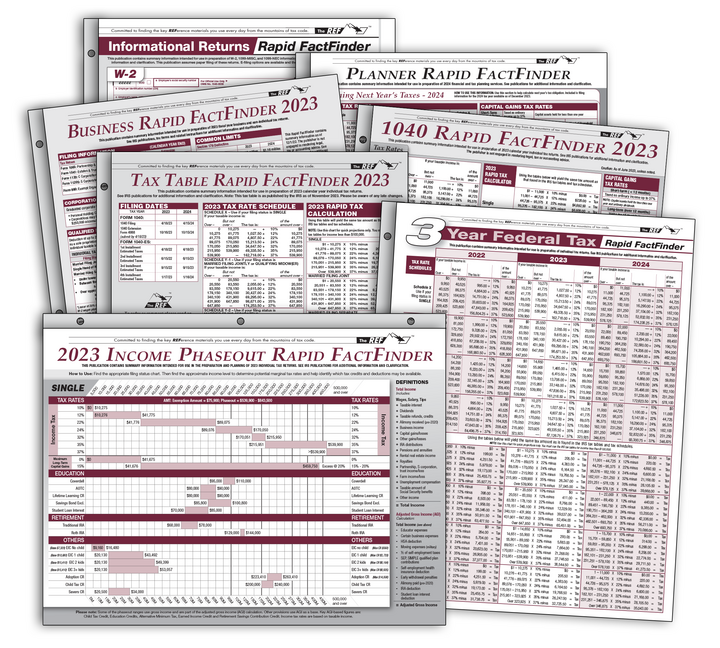

Source : www.beachaudio.comThe REF FactFinder SERIES 2023 (7 products) Item: #90 399

Source : www.tangiblevalues.comFederal Income Tax Spreadsheet Form 1040 (Excel Spreadsheet

Source : sites.google.com2024 1040 Schedule Excel Easy to Use Worth Spreadsheet 2024 (Template for Google Sheets : One simple way to set up your business expense worksheet is to open the IRS Form 1040 Schedule C form (See Resources such as Microsoft Excel or OpenOffice Calc (free), to develop your expense . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

]]>