Qualified Business Deduction 2024 Meaning

Qualified Business Deduction 2024 Meaning – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . MORE LIKE THISTax credits and deductions Tax preparation and filing you can claim these 2023 tax credits on the tax return you file in 2024. Keep in mind that the sections below are just .

Qualified Business Deduction 2024 Meaning

Source : www.freshbooks.comSection 179 Deduction – Section179.Org

Source : www.section179.orgQualified Business Income Deduction (QBI): What It Is NerdWallet

Source : www.nerdwallet.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comBluegrass Professional Associates | Louisville KY

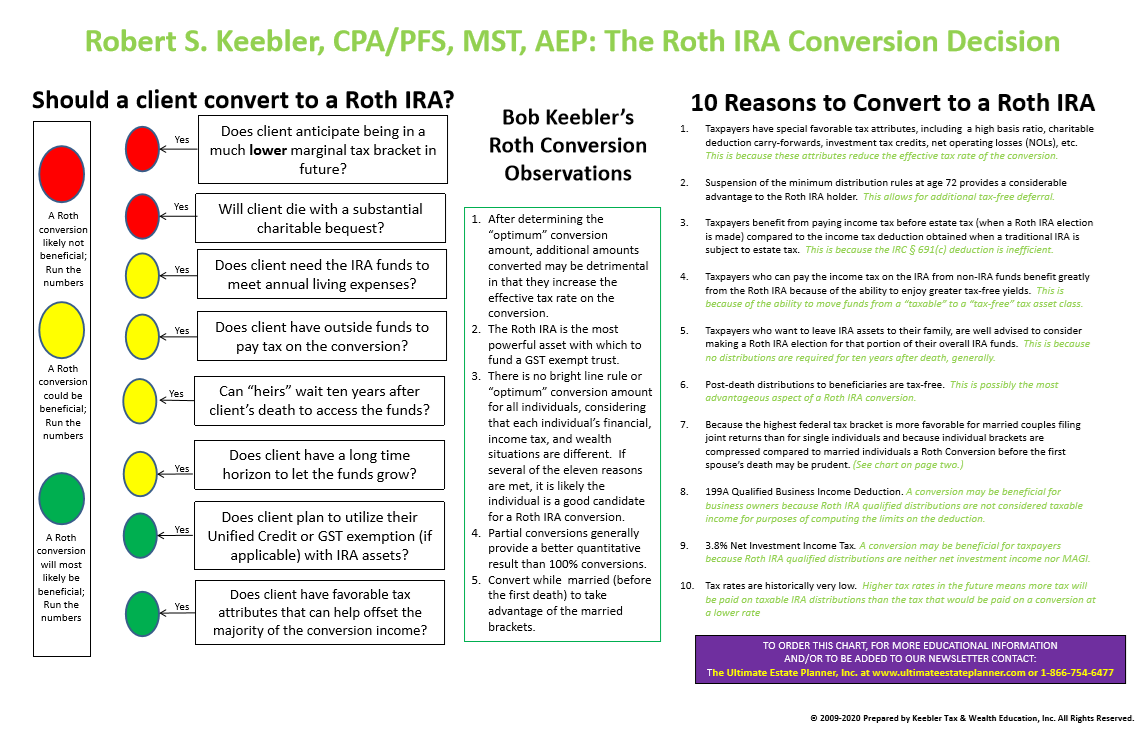

Source : www.facebook.comRoth IRA Conversion Decision Chart 2024 Ultimate Estate Planner

Source : ultimateestateplanner.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comBrian Sanvidge on LinkedIn: #anchin100 #construction #design

Source : www.linkedin.comFirst State CPAs and Associates | Dover DE

Source : www.facebook.comQualified Business Income Deduction (QBI): What It Is NerdWallet

Source : www.nerdwallet.comQualified Business Deduction 2024 Meaning 25 Small Business Tax Deductions To Know in 2024: There are tons of popular tax breaks out there. Whether you’re a new car owner, a student loan payer or a retiree with high medical costs, there are some important ones to know about. . However, some building improvements now qualify for the deduction. Value limit: All companies that lease, finance or purchase business equipment valued at less than $3,050,000 for 2024 qualify for .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)