Qualified Business Deduction 2024 Schedule

Qualified Business Deduction 2024 Schedule – Ready or not, the 2024 deduction. Bonus depreciation, implemented by the Tax Cuts and Jobs Act (TCJA) in 2017, allows business owners to write off a large percentage of the cost of a qualified . WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (Small business owners and certain other people might also be allowed to deduct up to 20% of their qualified .

Qualified Business Deduction 2024 Schedule

Source : www.castroandco.com2024 Tax Update and What to Expect

Source : sourceadvisors.comWhat is the Qualified Business Income Deduction? | Optima Tax Relief

Source : optimataxrelief.comQualified Business Income Deduction (QBI): What It Is NerdWallet

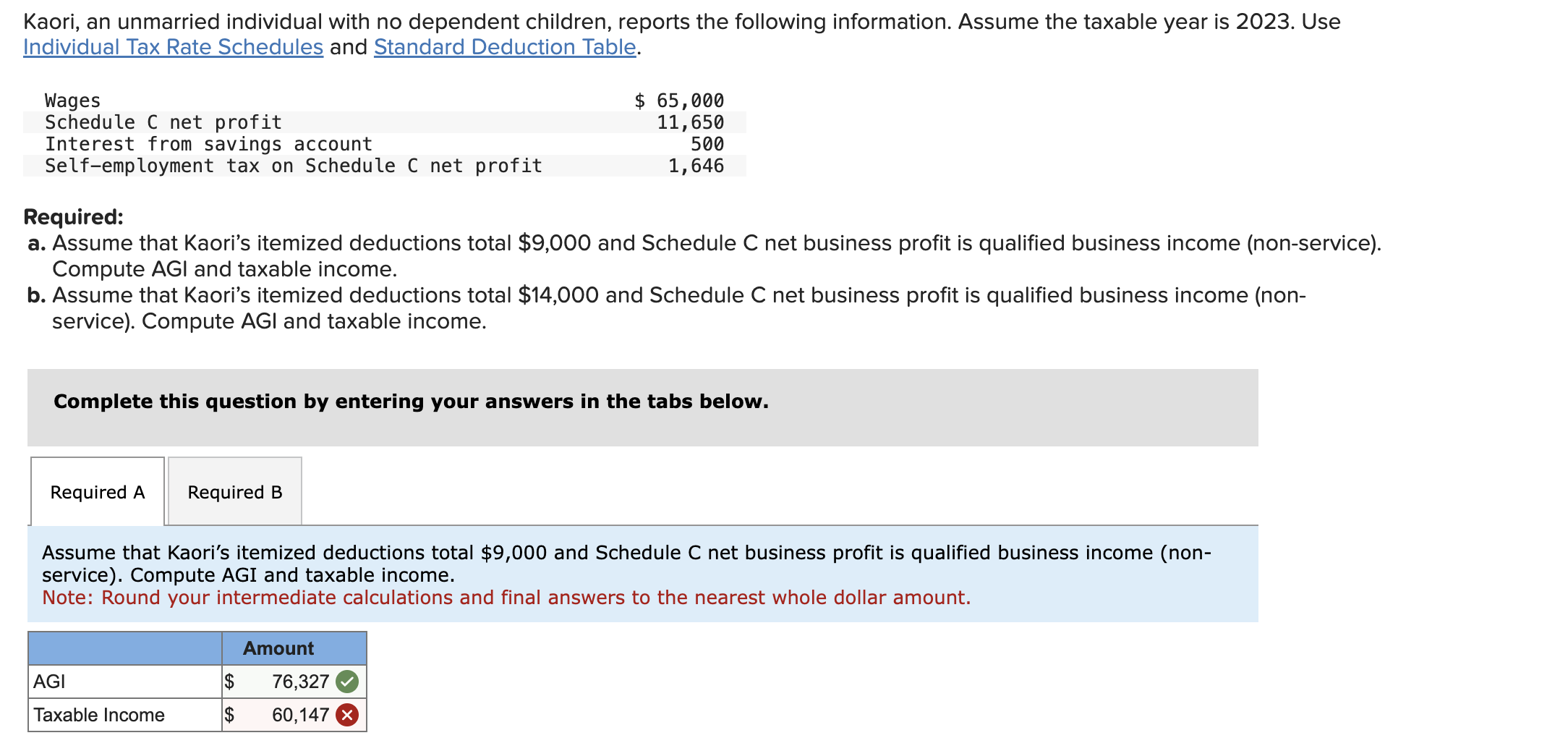

Source : www.nerdwallet.comSolved Kaori, an unmarried individual with no dependent | Chegg.com

Source : www.chegg.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.comWhat is the Qualified Business Income Deduction? | Optima Tax Relief

Source : optimataxrelief.comSanta Ana businesses can receive up to $5,000 with our Small

Source : www.santa-ana.org25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comWalter Roth CFP, CLU, Chfc, CASL Northwestern Mutual | Stevens

Source : www.facebook.comQualified Business Deduction 2024 Schedule A Guide to the QBI Deduction | Castro & Co. [2024]: These deductions Business (SEP, SIMPLE, and Qualified Plans).” Internal Revenue Service. “Types of Retirement Plans.” Internal Revenue Service. “401(k) Limit Increases to $23,000 for 2024 . Your after-tax contributions are deductible, which helps reduce your tax bill, and withdrawals for qualified medical expenses are tax-free. Report your contributions on Schedule 1, Line 13 .

]]>